According to a recent survey of the Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA) membership, the share of the different types of farmland leases are:

- 25% share rent

- 9% modified share rent

- 25% cash rent

- 35% variable cash rent

- and 7% custom farming

The share of variable cash rent leases has been increasing over time and share rent leases have been declining.

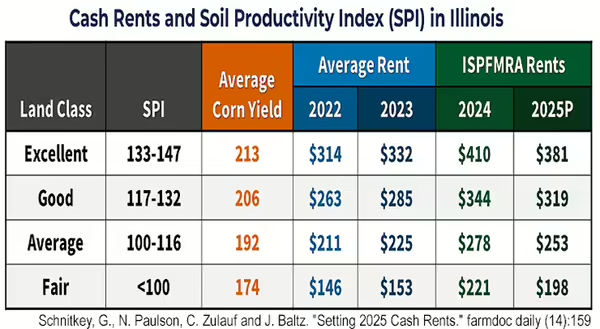

This ISPFMRA survey revealed that professional farm managers are expecting average cash rents on “excellent” quality farmland to fall from $410 per acre in 2024 to $381 per acre in 2025 or an 8% decline. The same 8% decline holds true for “good” quality farmland. The “average” and “fair” quality farmlands will see expected declines of 9% and 10%, respectively.

An article published on farmdocDAILY, Setting 2025 Cash Rents, provides an overview of the survey. In this article, the authors point out that the average USDA-reported 2024 cash rent for “excellent” quality Illinois farmland was $332 per acre or $79 less than the professionally managed farmland. “Various reasons can be given for this difference, including the desires of farm owners who seek professional management for higher returns.”

How do you determine the cash rent value of your farmland?

At a recent meeting, Kevin Brooks, Extension Farm Business Management and Marketing Educator, outlined a rather simple method for estimating a range of cash rents for a farm.

To do this you need to know:

- The Actual Production History (APH) for that particular parcel of land

- The estimated value for fall 2025 corn delivered to the nearest elevator

- And a rent factor (36 to 40% for corn; 40 to 44% for soybean)

APH is a trend-adjusted production average as determined by the Federal Crop Insurance Corporation for the farm. If this is not available, an average of 5 production years for a particular crop on that parcel will give you a close approximation of your APH. Kevin pointed out that the rent factor can be adjusted up or down to suit the situation. The University of Illinois in the past has recommended a rent factor of 32% for corn and 43% for soybean in central and northern Illinois”.

Let’s say that you have a farm in Piatt County with an average soil productivity index (SPI) of 142, which makes it excellent quality land. It has an APH of 242 bushels per acre for corn. The average of the 2025 fall corn delivery price to the local elevator is $4.00 per bushel. To get the range of expected cash rents for this farm:

242 (APH) X $4 (fall 2025 average corn price) X 0.36 or 0.40 (rent factor) = $348 to $387 per acre cash rent range

There is a short 9-minute video that you can watch in which Kevin explains how to calculate your estimated cash rent value using the above formula, and he goes into greater detail.

If your farm operator approaches you about the idea of switching to a “flexible” or variable cash rent lease, the University of Illinois farmdoc team of economists has developed A Straight Forward Variable Cash Lease. This walks you through a simplified method for developing this type of lease.

About the Author

Doug Gucker is a Local Food Systems and Small Farms Extension educator with University of Illinois Extension. He improves producer profitability and sustainability through demonstration and programming focused on using appropriate management strategies in all aspects of production. His work demonstrates practices in the areas of farm management; soil health; nutrient management; integrated pest management and grazing.