Time is a precious asset, especially for any person looking to invest or put money away for retirement. Many people may not realize just how important and simple using time to their advantage can be.

Time value of money and compounding interest are two important factors to consider when using time to one’s advantage. The time value of money is a concept claiming that a dollar in your possession today is worth more than a dollar promised in the future. This is because a dollar in your possession today can be invested and used to earn interest. Interest is a percentage of money earned on top of the original amount put into an investment account.

Additionally, compound interest is related to this concept because money put into investments now will gain compounded (added) interest that could not be earned on a dollar in the future. Compounded interest is money earned on an investment at an exponential rate over time rather than a typical linear rate earned by regular interest. Compounded interest is also different from simple interest in the sense it builds based not only on the original amount invested but also on the interest made over time. This means the money a person invests now will dramatically increase over time as the amount in the investment account continues to grow.

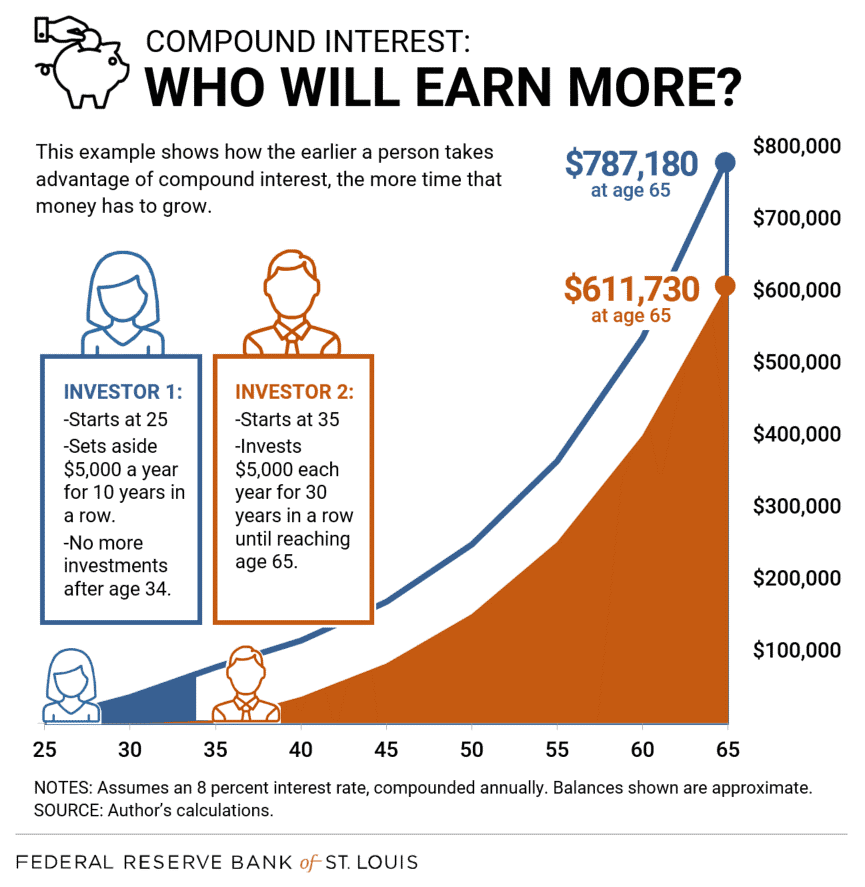

For example, if you look at the image below you can see the impact a ten-year time difference has on the total money a person has compounded interest on for retirement. Investor 1 started at 25 years old and invested $5,000 per year for 10 years in a row, stopping at the age of 34. On the other hand, Investor 2 did not start investing until the age of 35 and continued to invest each year until 65. Even though Investor 1 only invested for 10 years Investor 1 still ended up with more money for retirement. This occurred because of the magic of compounding interest and time that comes with starting early. As time passes, the interest on the money put into investments continues to increase, or compound, in addition to the original amount put into the account. Even after 30 years Investor 2 was still not able to make up for lost time. Therefore, students who begin investing early will have a huge advantage over those who wait a few more years.

Graph: Reproduced with permission of the Federal Reserve Bank of St. Louis, Open Vault blog, Sept. 12, 2018: How Does Compound Interest Work? © 2018 Federal Reserve Bank of St. Louis

Written by Arianna Pannarale, Financial Wellness for College Students Peer Educator, University of Illinois Extension, Spring 2021. Reviewed by Kathy Sweedler, University of Illinois Extension, March 2023.

For more financial education content, follow us on Instagram, Facebook, or Twitter.

Photo by Stas Knop