The farm economy in central Illinois is entering yet another year of financial pressures. Recent projections show that, despite slight increases in market prices, many corn and soybean producers could expect negative returns. Long-term data shows that 2024 was the lowest income year for grain farms since the 1990s, which leaves more operations in a weaker financial position moving into 2026. Support from the U.S. federal government, through ARC/PLC changes and Farmer Bridge Assistance payments, will play a role in helping the financial position and outlook for producers. This blog post will provide an overview of what corn and soybean producers in central Illinois should know in 2026. It will cover financial trends, crop budgets, government payments, and more topics that will have an impact on profitability and financial performance using data and information from the farmdoc team at the University of Illinois. This will help farmers, landowners, agribusinesses, and rural communities understand the challenges and decisions that lie ahead.

Long-Term Financial Position

Before looking to what 2026 may bring, it is important to consider the historical position of grain farms in Illinois. According to a December 2025 farmdoc daily article, using data from Illinois Farm Business Farm Management (FBFM), profitability in 2024 was the lowest it had been since 1990. This was due to market prices falling while costs of production remained higher. Despite the historically low incomes, many farms remained in good financial shape. The average liquidity and solvency positions of grain farms in Illinois remained strong, which helped them be stable during turbulent financial times. Additionally, government support payments were a significant source of income for some operations in 2024. It is also important to consider the impacts on new and beginning producers compared to established producers. The authors note that established producers will face fewer difficulties during times of low profitability than new or beginning farmers. This is because new and beginning farmers are cash-renting more of their land, adding additional costs. The authors note that, in order for profitability to increase, a couple of things would need to occur. The first is an increase in gross returns while costs remain the same. This would be through an increase in market prices, and ad hoc government payments could provide additional relief. The second is that costs decline while returns remain steady. This would be from reductions in costs of inputs such as fertilizer and seed, or even decreases in cash rents. Some operations will need to have a combination of both in order to strengthen their financial position.

2026 Crop Budgets

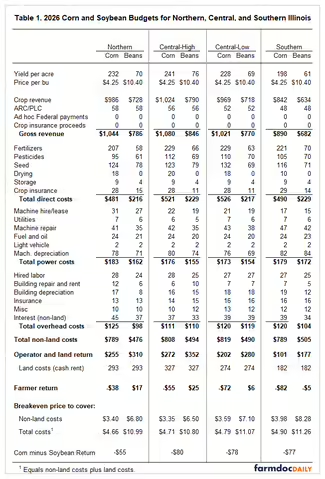

Each year, the farmdoc team publishes budgets for growing corn and soybeans in northern Illinois, southern Illinois, and for high and low productivity farmland in central Illinois. Originally published in August 2025, revisions for 2026 were published in January 2026. The budgets estimate gross revenues, non-land and land costs, expected returns, and breakeven prices to cover non-land and total costs. This post will focus on the corn and soybean budgets for high productivity farmland in central Illinois.

The budget estimates yield at 241 bushels/acre for corn and 76 bushels/acre for soybeans, which are close to trend line yields projected by the United States Department of Agriculture (USDA). The authors go on to estimate the price of corn at $4.25 per bushel and $10.40 per bushel for soybeans, plus an additional $56 per acre ARC/PLC payment, which results in gross revenues at $1,080 per acre for corn and $846 per acre for soybeans.

Next in the budget are the non-land and land costs. The non-land costs are broken down into three different sections. Among these non-land costs, direct costs (fertilizers, seeds, grain storage, etc.) are the highest for corn and soybeans ($521 and $229 per acre, respectively). Total non-land costs are estimated at $808 per acre for corn and $494 per acre for soybeans. If there are no land costs, the returns per acre (gross revenue – total non-land costs) are $272 per acre for corn and $352 per acre for soybeans.

Land costs account for cash rent, which the authors set at $327 per acre for both corn and soybeans. When adding these to the equation (gross revenues – non-land costs – land costs), returns are -$55 per acre for corn and $25 per acre for soybeans. To cover just non-land costs, the breakeven prices are estimated at $3.35 per bushel for corn and $6.50 per bushel for soybeans. To cover all costs, the breakeven prices are $4.71 per bushel for corn and $10.80 per bushel for soybeans.

Government Support Payments

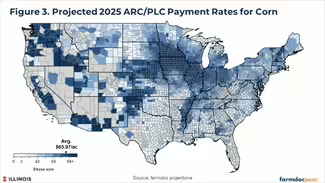

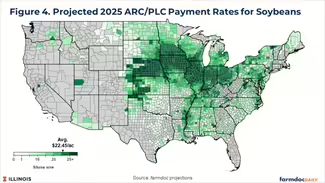

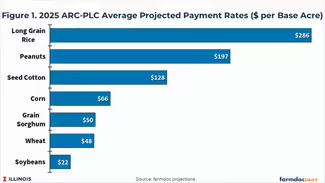

There were many changes made in 2025 when it came to government support payments. The One Big Beautiful Bill Act (OBBA), enacted in the summer of 2025, made changes to the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs that will affect the 2025 crop year. As part of the changes, eligible recipients will receive the higher of ARC and PLC, no matter what the recipient elected in 2025. The expected total amount of payments from these programs is approximately $13.5 billion. A farmdoc daily article published in November 2025 estimated the average per acre payment rates for the commodities covered by ARC and PLC. The average per-acre payment rate for corn is $65.97, $22.45 for soybeans, and $48.27 for wheat. It is important to note that any payments from ARC or PLC will not be distributed until October 2026.

But payments from ARC and PLC will not be the only source of government support for producers. The USDA announced on Dec. 31, 2025, the Farmer Bridge Assistance (FBA) program, making $11 billion available to eligible row crop producers. Payments are expected to be delivered in February 2026 through the USDA Farm Service Agency (FSA). An eligible person/entity must have an adjusted gross income (AGI) under $900,000, and there is a payment limit of $155,000 per person/entity. The per-acre payment rates were set at $44.36 for corn, $30.88 for soybeans, and $39.35 for wheat. A farmdoc daily article from January 2026 estimates that, on a 1,500-acre farm with half of its acres in corn and half in soybeans, would receive approximately $56,400 from the FBA program. While the FBA payments will help improve returns for grain operations, it is likely that a significant portion of operations in Illinois will still have negative returns for the 2025 crop year.

Illinois grain farms are coming into 2026 with both strengths and challenges. While many still have strong balance sheets and financial positions, low returns over the last few years will continue to place financial pressure on many operations. This blog post discussed the long-term trends in financial positions, estimated crop budgets for 2026, and government payments. Understanding these trends and challenges will help producers make decisions about costs and financial planning. Careful management and decision making is important for long-term stability during these challenging economic conditions. For additional information from farmdoc on the current financial position, visit the following articles.

- Revenues and Costs for Illinois Grain Crops (January 2026)

- Projected Incomes on Owned vs Rented Farmland for 2026 (January 2026)

- Additional ARC/PLC Payments for 2025: Value of Receiving the Maximum Program Payment (November 2025)