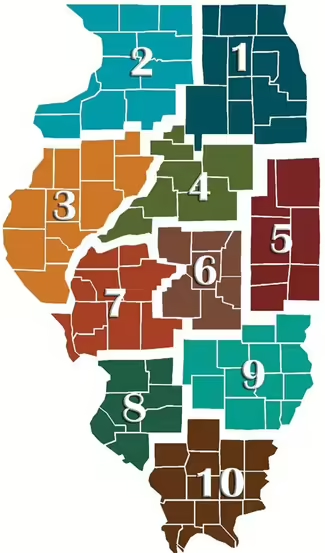

This blog is the second part of a two-part series analyzing the 2025 Farmland Values Report published by the Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA). The report highlights the value of farmland sold in 2024, expectations for farmland values in 2025, and factors impacting farmland sales and the overall agricultural economy. Part one examined key trends across the state and the survey results from the Society’s members regarding their use of farmland leases and their perspectives on the future of farmland values in 2025. This second part will specifically look at the sales of excellent, good, average, and fair farmland in Logan, Menard, and Sangamon counties and their respective regions from 2024. As a refresher, the classification for farmland is based on the soil productivity index (soil PI), with the different classes being:

- Excellent (Class A): PI between 133-147,

- Good (Class B): PI between 117-132,

- Average (Class C): PI between 100-116, and

- Fair (Class D): PI less than 100.

In 2024, there were over 100 sales of excellent productivity farmland in Region 6. The sale price per acre ranged from $11,000 to $22,508, with an average value of $17,210 per acre. The average PI of the tracts listed in the report was 139.7. Cash rents in the region ranged from $350 to $500 per acre, with the average cash rent being $435 per acre. A significant majority (75%) of leased excellent farmland in the region used a flexible cash rent agreement, with 15% using a traditional cash rent and five percent using a share rent agreement. Logan County recorded 17 sales of excellent farmland in 2024, with an average sale price of $16,643 per acre and an average PI of 140.16.

In Region 7, the range of sale price per acre for excellent productivity farmland was between $15,750 and $19,800 per acre, with an average of $17,046 per acre. The average PI was 138.0. Cash rents in the region ranged from $350 to $500 per acre, with an average of $425 per acre. The type of leasing arrangement was different compared to Region 6, with 45% of leases being flexible cash rents, 40% being traditional cash rents, and ten percent being share rents. Four tracts of excellent productivity farmland were sold in Sangamon County in 2024, with an average sale price of $19,650 per acre and an average PI of 141.25. Only one tract was sold in Menard County, with an average PI of 135.5 and an average price of $15,300 per acre.

A total of 37 good productivity tracts were sold in Region 6 in 2024, with the sale price per acre ranging from $8,000 to $18,105 and an average of $13,268 per acre. The average PI of the tracts was 127.7. Cash rents in the region ranged from $300 to $400 per acre, with an average of $350 per acre. The leasing arrangements for good productivity farmland in the region were the same for excellent productivity; 75% of leased farmland used flexible cash rents, 15% used traditional cash rent, and five percent used share rent agreements. Only one tract of good productivity farmland was sold in Logan County with an average PI of 126 and an average sale price of $10,500 per acre.

Around 23 good productivity tracts were sold in Region 7 in 2024, with the sale price per acre ranging from $7,950 to $20,000 and an average of $13,302 per acre. The average PI of the tracts was 127.1. Cash rents in the region ranged from $280 to $425 per acre, with an average of $375 per acre. The leasing arrangements used in the region were approximately the same as excellent productivity leases; 45% of leased farmland used a flexible cash rent agreement, 40% used a traditional cash rent, and ten percent used a share rent. There were four tracts of good productivity farmland sold in Sangamon County in 2024, with an average PI of 128.03 and an average sale price of $14,075 per acre. There were no sales of good productivity farmland reported in Menard County.

Region 6 saw a total of 24 sales of average productivity farmland tracts in 2024, with the range of sale price between $7,333 and $13,046 per acre and an average sale price of $9,386 per acre. The average PI of the tracts was 108.4. Cash rents in the region ranged from $250 to $325 per acre, with an average of $295 per acre. Again, 75% of average productivity farmland leases were flexible cash rents, 15% were traditional cash rents, and five percent were share rents. No tracts of average productivity farmland were sold in Logan County.

Region 7 saw approximately the same number of average productivity farmland tracts sold in 2024, with the range of sale price between $5,313 and $13,689 per acre and an average sale price of $9,539 per acre. The average PI of the tracts was 110.7. Cash rents in the region ranged from $250 to $3000 per acre, with an average of $275 per acre. Among the leased average farmland in the region, 60% used a flexible cash rent agreement, 20% used a traditional cash rent, and 15% used a share rent agreement. Only one tract was sold in Sangamon County with an average PI of 108.9 and an average sale price of $12,600 per acre. No tracts were reported sold in Menard County.

Region 6 saw five tracts of fair productivity farmland sold in 2024, with the sale prices ranging from $6,816 to $10,150 per acre and an average sale price of $7,929 per acre. The average PI of the tracts was 96.4. Cash rent for fair productivity farmland in the region ranged from $200 to $270 per acre with an average of $250 per acre. Among leases for fair productivity tracts, 75% used a flexible cash rent agreement, 15% used a traditional cash rent, and 15% used a share rent agreement. There were no tracts of fair productivity farmland sold in Logan County.

Only six tracts of fair productivity farmland were sold in Region 7 in 2024, with the sale price ranging from $4,600 to $14,500 per acre and an average sale price of $6,480 per acre. The average PI of the tracts was 92.6. Cash rents in the region ranged from $200 to $250 per acre, with an average cash rent of $225 per acre. Among leases for fair productivity farmland, 60% used flexible cash rents, 20% used traditional cash rents, and 15% used share rent. No tracts were sold in either Sangamon or Menard counties.

The 2025 Farmland Values Report provides valuable insights into the agricultural land market across Illinois. Part one of this blog series explored the broader trends affecting farmland values and lease rates, highlighting factors such as commodity prices, interest rates, and regional differences. Part two focused specifically on Logan, Menard, and Sangamon counties, detailing the local land values and lease trends. These counties reflect broader statewide patterns, with some unique regional variations. Understanding these trends is crucial for making informed decisions about buying, selling, or leasing farmland in these areas. Together, these insights offer a comprehensive view of the current agricultural land market in Illinois, helping stakeholders navigate the complexities and opportunities in 2025.