Do you want to get the most bang for your buck? Of course you do! We all know there are only so many dollars in our paycheck and an endless number of opportunities to spend those dollars. Being creative and very conscious of your spending goes a long way to stretching your dollars.

Check Your Bills Carefully

When was the last time you looked carefully at each line of your bills like your utility, TV, internet or phone bill? Do you know what the individual charges are that add up to your overall bill? When you look closely, there is often more than you think to your bill. Sometimes small amounts are added that you may not be aware of, and sometimes we sign up for add-on services that, in hindsight, are not important to us. You may be able to reduce these items and stretch your dollars.

Especially check your credit card bills for subscriptions or services that you do not want now. Cancel these costs and save!

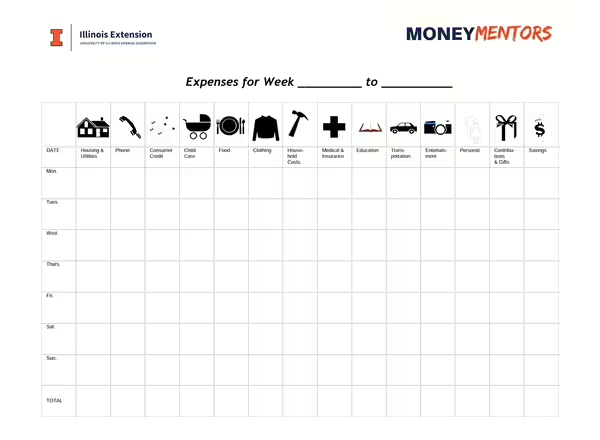

Track Your Expenses

Tedious at times but highly effective, tracking where you spend money is a worthwhile activity. Use a phone app or a website, paper and pencil, or collect receipts – whichever works best for you. If you do track expenses for six weeks or more, you'll gain good information about where your dollars go. Then you can decide if this is what you want, or do you want to redirect your dollars.

Explore Community Resources

Have you considered substituting community resources for spending? One example of this is using your public library instead of buying books. Another is riding the bus instead of buying a car. Other community resources may be available in your community to help with food costs, transportation, or utility payments. In Illinois, call 211 to reach a knowledgeable person, 24/7, who can help you find services.

All calls to 211 are free, anonymous, and confidential.

Be Aware of Small Amounts

Do you have any habits that cost a small amount but you do frequently? You might be surprised how these relatively small costs can accumulate. Five lunches eaten in a restaurant, a week, at $10 per lunch adds up to $2600 a year.

| Item | Cost | Annual Cost |

|---|---|---|

| Soft drink | $1.50/day | $547 |

| Cigarettes | $7.50/week | $2737 |

| Game subscription | $15/month | $180 |

Re-think Fixed Costs

Fixed costs are those that are the same each month and typically involve a contract like a rental agreement or insurance payment. You may want to consider downsizing your living situation or comparison-shopping for your insurance premiums to decrease expenses.

Make financial changes one step at a time. Choose one of the above strategies to try this week. Then try another strategy another week. You’ll be surprised at how these financial changes can add up!

Originally posted April 2017; updated June 2023.

Track your expenses to see where your money goes. Then you can make informed decisions to stop money leaks. Use a simple paper table, an app, or a spreadsheet. Do what works best for you!

Kathy Sweedler provides personal finance online education with Illinois Extension. Kathy’s emphasis is to encourage people to be confident in their financial decisions, and to help them explore new ways of thinking about and managing money. When Kathy is not engaged in Extension work, she is often traveling and piecing together family genealogy. Genealogy is a puzzle, not that different from managing money!

Sign up for Illinois Extension’s Personal Finance E-Newsletter sent quarterly to receive updates about blog posts and events.