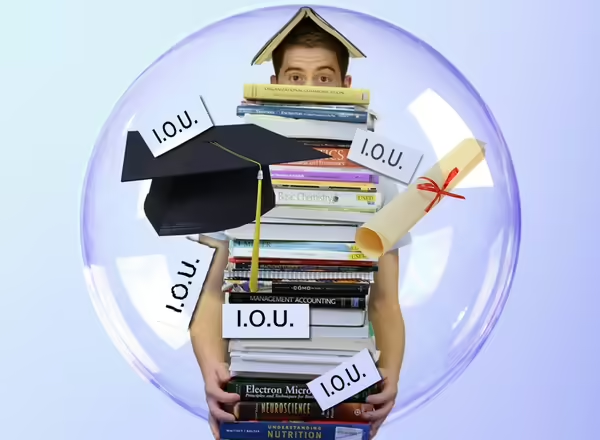

The clock is ticking on organizing your student loan repayment. After several years of pause, federal student loan payments are due, as of October 2023. Interest accrual is back in full force. Other changes may affect you too!

Take time to check if you benefit from:

- The SAVE (Saving on a Valuable Education) Plan. This new IDR (Income-Driven Repayment) Plan may lower your monthly payments significantly.

- The Fresh Start. If you’re currently in default, taking advantage of Fresh Start may remove the record of your default from your credit report and return your defaulted loans to “in repayment” status.

- Loan forgiveness. Approximately 3.4 million people’s federal student loans have been forgiven in the last few years. Have you checked the status of your loans?

Re-evaluate your loan repayment plan options

A new IDR plan, the SAVE Plan, has higher income limits than previous IDR plans plus loan amounts won’t grow from interest compounding. Interest that is not covered by a person’s monthly payments is paid by the US government.

For example, for a single person making $32,800 (or less) a year, their monthly payment will be $0. For a family of four, the income limit is $67,500 for $0 payments. This $0 payment will still count as credit towards IDR plan forgiveness.

The SAVE Plan isn’t for everyone but it’s well worth your time to explore. Use the loan repayment simulator from the U.S. Department of Education to see which repayment plan option is best for you.

In default? Check out Fresh Start

If you have a federal loan in default, this can haunt you for years and years. Fresh Start is a temporary program (act now!) and can help move your loan from default to in repayment. Your first step is to contact your loan holder. Once you’re out of default, then you will choose a repayment plan like an income-driven repayment plan. Learn more about qualifications at the Federal Student Aid website.

Check your loans’ current status

With all the pandemic craziness and regulation changes, it’s easy to lose track of your student loan status. Currently the on-ramp transition process is giving many people a little breathing room. Late payments won’t send you into default. However, the payments are still due and interest is adding up.

If you haven’t restarted your payments, read our blog post, Student loan update: Supreme Court decision, to see steps to transition back to payment.

Be sure to check if student loan forgiveness might be a good fit for your situation.

No matter where you are in the student loan repayment process, reevaluating your options at least once a year is a best-financial-practice. This blog post is up to date as of November 10, 2023, but more changes are expected in the next few months. Stay informed and adjust to best fit your financial situation.

Image by stockking on Freepik

University of Illinois System Student Money Management Center (SMMC) and Illinois Department of Financial and Professional Regulation (IDFPR) are coordinating a monthly webinar series between July 2023 and March 2024 as federal student loans re-enter repayment after 3.5 years of a payment and interest pause for all federally held student loans.

All webinars will be on Fridays at 12 PM CT, run 10-20 minutes in length, and focus on different action items related to the management of federal student loans. Register for these free updates.

Regardless of where you are in your student loan journey, there are many things to remember when it comes to managing those loans from application to pay-off (or forgiveness). Join us via Zoom on May 3, 2024, to learn the terms, tips, and tools to make managing your education debt easier. Register for connecting information.

Are you hearing conflicting information about student loan repayment for federal loans? If so, go straight to reliable government resources like FederalStudentAid.gov and the Consumer Financial Protection Bureau and, of course, university resources like Illinois Extension. Be wary of scams!

Kathy Sweedler provides personal finance online education with Illinois Extension. Kathy’s emphasis is to encourage people to be confident in their financial decisions, and to help them explore new ways of thinking about and managing money. When Kathy is not engaged in Extension work, she is often traveling and piecing together family genealogy. Genealogy is a puzzle, not that different from managing money!

Sign up for Illinois Extension’s Personal Finance E-Newsletter sent quarterly to receive updates about blog posts and events.