URBANA, Ill. - During the COVID-19 pandemic, budgets were stretched tight, and every dollar counted. That's why Illinois Extension consumer economic educators make financial discussions easy to understand so you can explore your options and make informed decisions. Around the state and close to home, we offer reliable, unbiased research-based information through live workshops and webinars.

Money Mentors volunteers help community members achieve financial goals

Financial education and coaching can make a huge difference in people’s lives. Illinois Extension Money Mentors are trained volunteers who offer free unbiased resources and quality information to help others navigate financial challenges and reach their goals. Across the state, Money Mentors advise building savings, managing credit, and organizing finances. Program participants say they experience an increase in emergency and long-term savings and an overall decrease in debt.

Nine new volunteers became Money Mentors in Grundy, Kankakee, and Will counties teaching about budgeting, debt repayment, and money management.

In Champaign, Ford, Iroquois, and Vermilion counties, 179 community members were matched with a Money Mentor in 2021. Their local program serves a diverse group of participants with a median income between $25,000 to $34,999, with incomes ranging below $15,000 to over $150,000 annually. Participants ranged from late teens into their 70s.

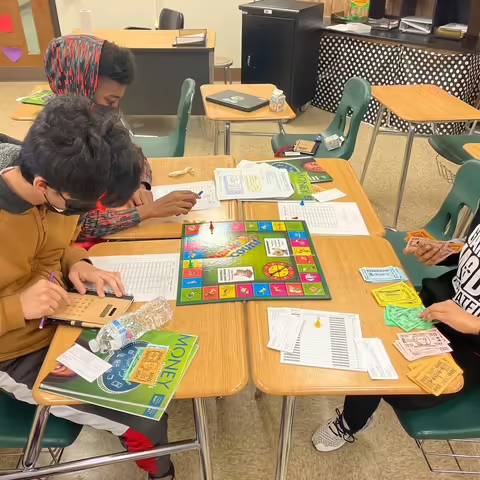

Simulations prove that experience is the best teacher

Money mistakes can be costly, but simulation programs give people of all ages the chance to explore financial situations risk-free from a new perspective.

Welcome to the Real World is a financial literacy program for youth offered by Illinois Extension in Henderson, Knox, McDonough, and Warren counties. In the session, students select a career and are responsible for a month’s worth of bills. In 2021, staff pivoted the in-person workshop to comply with school COVID-19 policies and were able to reach 400 students.

What is it like to live in poverty? For many, it’s hard to imagine the daily struggle to survive. Extension staff and partners in Henry, Mercer, Rock Island, and Stark counties led four interactive Poverty Simulation workshops in 2021 for local school districts, nonprofits, and government agencies. In the two-hour workshops, 175 total participants learned about and discussed poverty on the local level and its impact on families, businesses, and organizations, and efforts to alleviate it. Participants left with a better understanding of the coping strategies that impoverished people take and the recognition that survival is their total focus.

Financial literacy is a lifelong journey

Becoming a good money manager requires practice and conversations. Learning about healthy financial habits at a young age can set a child up for success.

In Will County, 4-H Educator Jamita Brown teamed up with family and consumer science staff to lead the Smart Cents program for underserved youth. By completing challenges, youth learned about budgeting, saving and investing, career choices, and more. Participants went home with financial literacy learning materials workbooks, a piggy bank, and flashcards from a Black-owned local business.

Conversations with adults help young people understand the importance and power of financial management. Extension staff in Champaign County provided more than 100 families with financial picture book reading guides at community events. More than 200 8th graders attended a three-session online webinar series on financial education for young adults.

At the college level, 13 University of Illinois students completed a financial internship with Illinois Extension. The students met with their peers to answer money questions, wrote educational blog posts, updated educational resources, and led personal finance workshops. Some of the most popular topics in 2021 included financial technology, protecting against fraud, and comparing financial institutions.

Nearly 600 people signed up for Let’s Talk Money in 2021, a free eight-part webinar series for adults led by Consumer Economics educator Camaya Wallace in Livingston, McLean, and Woodford counties. Each session worked to build financial confidence by providing relevant and timely financial information to consumers in a year of uncertainty and questions.

Learn more about how Illinois Extension’s financial programs and educators can help you on your financial journey at extension.illinois.edu/finances.

ABOUT EXTENSION: Illinois Extension leads public outreach for University of Illinois by translating research into action plans that allow Illinois families, businesses, and community leaders to solve problems, make informed decisions, and adapt to changes and opportunities.